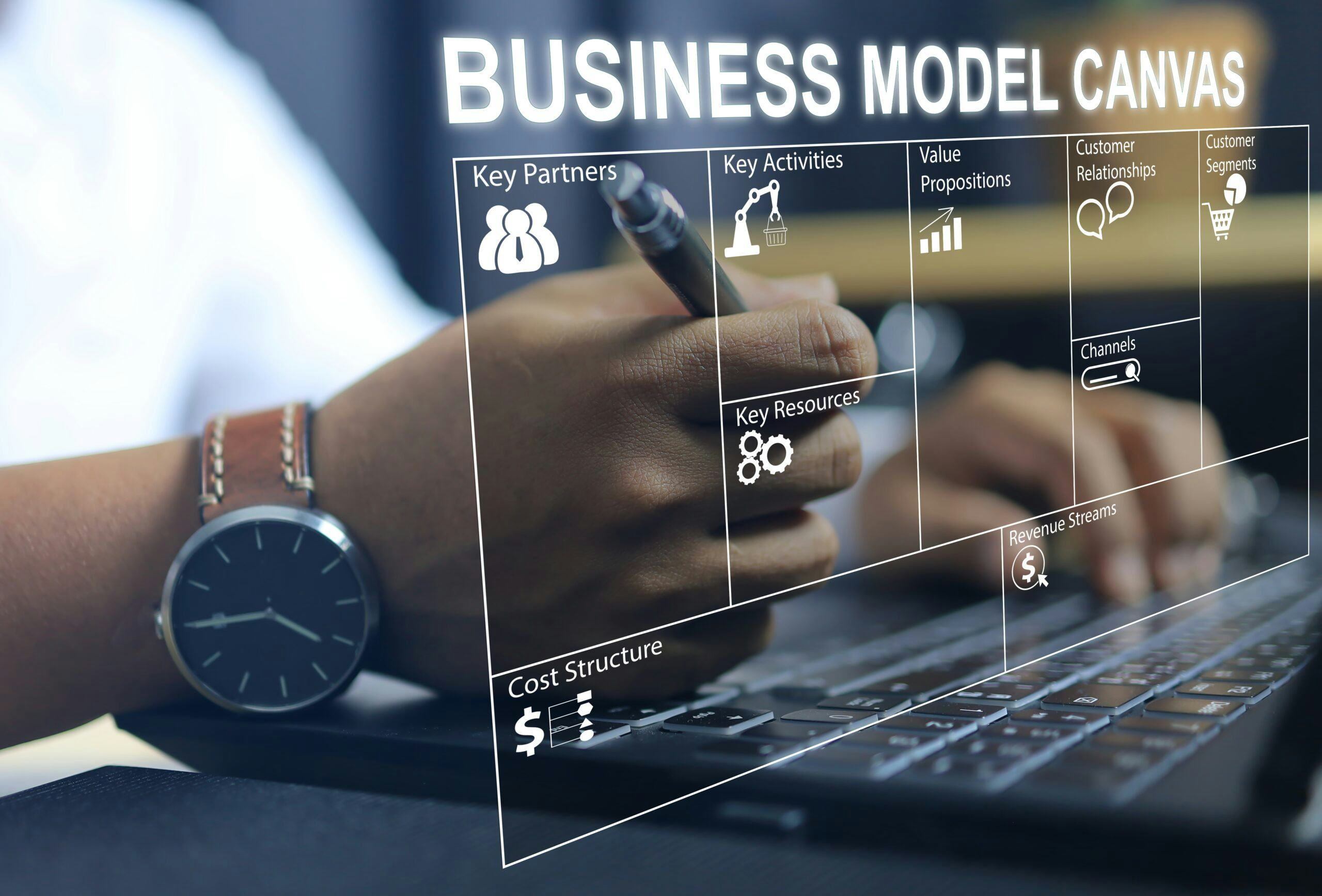

Stappenplan: zo werk je met het business model canvas

Businessmodelling staat voor een actieve analyse van een bestaande of nieuw op te richten organisatie. Deze is erop gericht de manier waarop de...

Businessmodelling staat voor een actieve analyse van een bestaande of nieuw op te richten organisatie. Deze is erop gericht de manier waarop de...

Nederlandse banken stellen dat de huidige aanpak van witwasbestrijding te weinig oplevert gezien de druk op klanten. Banken moeten in plaats van...

West-Europese cfo's zijn iets positiever gestemd over economische ontwikkelingen, hoewel het gemiddelde laag blijft en andere regio's minder somber...

Vorig jaar is er door participatiemaatschappijen 6,8 miljard euro geïnvesteerd. Daarmee is sinds de oprichting van de Nederlandse Vereniging van...

Of de Directeur Business Control Realisatie van Alliander, Albert-Jan Kroezen, alles onder controle heeft? 'Ik heb in al die jaren geleerd dat je...

Een verbetering van de vraag, hogere productievolumes en meer personeelswerving zorgen ervoor dat de inkoopmanagersindex (PMI) voor het eerst in...

Na twee jaar geeft de SER een update van de effecten van het ingroeiquotum en de streefcijfers voor beursvennootschappen. Wat zijn ook alweer de...

Na als RA gewerkt te hebben bij achtereenvolgens EY, Coolblue, Getir en Gorillas, geeft Gijs van Rhijn als Global Head of Finance nu de financiële...

De Raad van Commissarissen van Holland Casino heeft twee nieuwe aanwinsten: voormalig kwartiermaker Toekomst accountancysector Chris Fonteijn is de...

Het merendeel van de Nederlandse organisaties en bedrijven heeft momenteel géén beleid voor diversiteit en inclusie. Dat blijkt uit onderzoek...